boulder co sales tax vehicle

Fees are based on the empty weight and type of vehicle being registered CRS. You must remove your license plates when you sell your vehicle in Colorado the plates belong to the seller not the vehicle.

Recently Purchased Vehicles Boulder County

Colorado has a 29 sales tax and Boulder County collects an additional 0985 so the minimum sales tax rate in Boulder County is 3885 not including any city or special district taxes.

. Please note that we do not handle drivers license services. Real property tax on median home. The Boulder sales tax rate is.

For tax rates in other cities see Colorado sales taxes by city and county. Although the taxes charged vary according to location the taxes include Colorado state tax RTD tax and city tax. Owners of electric vehicles may qualify for up to 7500 for the federal tax credit and up to 2500 for the Colorado state tax credit.

The Colorado state sales tax rate is currently 29. This is the total of state county and city sales tax rates. The 2018 United States Supreme Court decision in South Dakota v.

13 rows Colorado Department of Revenue Sales Tax Division 303-238-7378 Boulder County Office of. This is the total of state and county sales tax rates. The total sales tax rate in any given location can be broken down into state county city and special district rates.

Boulder taxes and fees for new vehicle purchase. You can print a 8845 sales tax table here. We also have three office locations throughout the.

42-3-306 Additional fees may be collected based on county of residence and license plate selected. The County sales tax rate is. Please see Motor vehicle sales earlier in this publication for rules for determining the applicable local sales and use taxes.

DR 0800 - Use the DR 0800 to look up local jurisdiction codes. Boulder CO Sales Tax Rate. The minimum combined 2022 sales tax rate for Boulder Colorado is.

Any retail sale that is made in Boulder County is subject to county taxaon. Boulder County CO Sales Tax Rate. Salestaxbouldercoloradogov o llamarnos a 303-441-4425.

To find out your auto sales tax take the sales price of your vehicle and calculate 772 percent of this price. Boulder County does not issue licenses for sales tax as it is collected by the. The buyer can legally drive without plates within 36 hours of the sale to the local motor vehicle office or to their residence if after-hours or on the weekend.

Colorado collects a 29 state sales tax rate on the purchase of all vehicles. Local sales taxes to the county clerk at the time of registration. Vehicles purchased outside of Colorado Motor vehicle sales made outside of Colorado are not subject to Colorado sales tax.

Sales Tax for Vehicle Sales DR 0024 Form After completing this course you will be able to do the following. Sales Tax State Local Sales Tax on Food. The Colorado sales tax rate is currently.

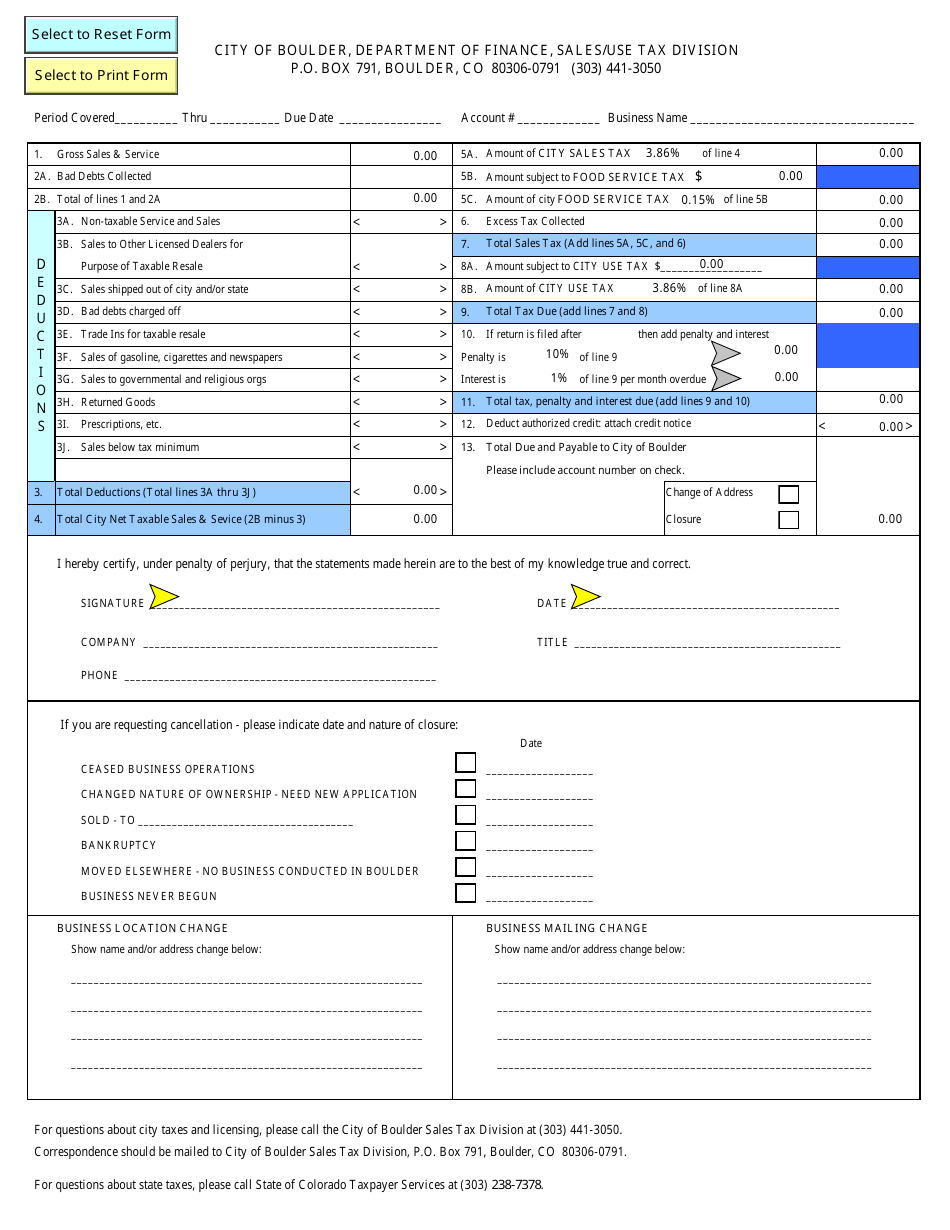

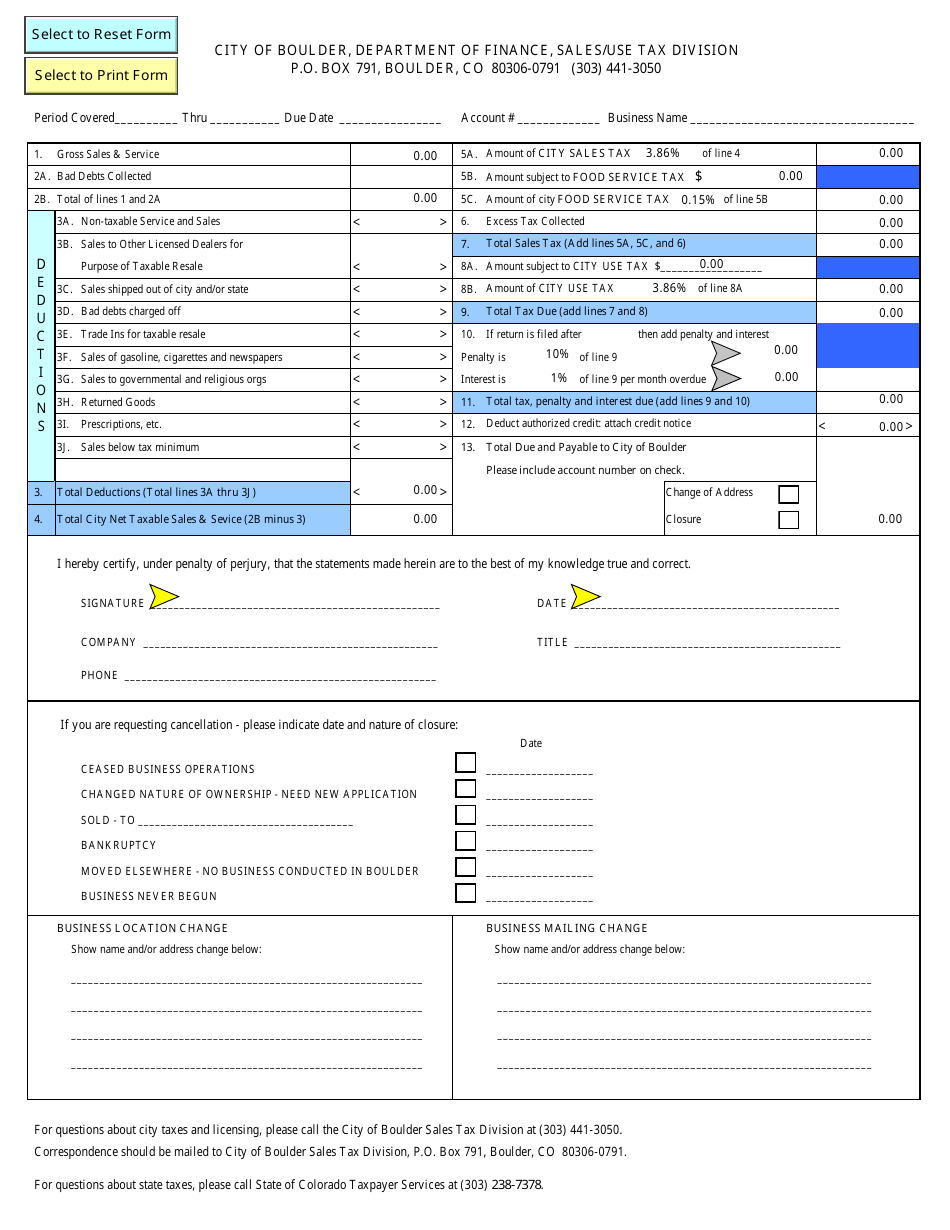

The current total local sales tax rate in Boulder CO is 4985. DR 0100 - Learn how to fill out the Retail Sales Tax Return DR 0100. The exact amount of your tax credits will depend on your EVPHEV model selection your tax liability and whether you purchase or lease the vehicle.

Sales tax and other fees will be collected by our office at the time of registration. The 8845 sales tax rate in Boulder consists of 29 Colorado state sales tax 0985 Boulder County sales tax 386 Boulder tax and 11 Special tax. However a county tax of up to 5 and a city or local tax of up to 8 can also be applicable in addition to the state sales tax.

This table shows the total sales tax rates for all cities and towns in. Proof of paid sales tax You will be required to pay Colorado Sales Tax at the time of registration but you may receive credit for any sales tax you already paid to another state if you provide valid proof of tax paid. The December 2020 total local sales tax rate was 8845.

BOULDER COUNTY SALES TAX TAX DISTRICT RATES Boulder County collects sales tax at the rate of 0985 on all retail transacons in addion to any applicable city and state taxes. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. Hello Trying to decode the Boulder county motor vehicle fees and taxes and the Colorado DMV website.

The Boulder County Motor Vehicle Division is the branch of the Clerk and Recorders office that certifies motor vehicle titles and registrations and acts as a division of the Colorado State Department of Revenue. To cite an example the total sales tax charged for residents of Denver amounts to 772 percent. The value of the tax credit is 35 of the vehicle purchase price or 50 of the vehicle conversion cost up to 7500 for vehicles with a gross vehicle weight rating GVWR up to 26000 pounds lbs and up to 25000 for vehicles with a GVWR greater than or equal to 26000 lbs.

Must be properly. Air Care Colorado or at a Boulder County Motor Vehicles location at the time of registration cost is 20. About City of Boulders Sales and Use Tax.

Most services are available online. Has impacted many state nexus laws. Posted by4 years ago.

Payment Please see our Fees Taxes page for details about how Motor Vehicle fees are calculated. This is the estimated. The Boulder County sales tax rate is 099.

In Colorado the seller must Must be notarized only if required on the title. Background - Understand the importance of properly completing the DR 0024 form. Para asistencia en español favor de mandarnos un email a.

The current total local sales tax rate in Boulder. The maximum tax that can be owed is 525 dollars. If you buy a new car in Boulder is it.

The minimum combined 2022 sales tax rate for Boulder County Colorado is 499. The citys Sales Use Tax team manages business licensing sales tax use and other tax filings construction use tax reconciliation returns and various tax auditing functions.

Boulder Cars Cars For Sale Boulder Co Cargurus

New Toyota Highlander Hybrid For Sale Lease Boulder Co Toyota Dealership Near Lakewood

Subaru Certified Preowned Used For Sale In Boulder Colorado L Flatirons Subaru

New Acura For Sale Near Denver Co Fisher Acura In Boulder Co

Certified Used Toyota Cars For Sale In Boulder Toyota Colorado Springs

Certified Used Toyota Cars For Sale In Boulder Toyota Colorado Springs

City Of Boulder Colorado Sales Use Tax Return Form Download Fillable Pdf Templateroller

New Toyota Sienna For Sale Lease Boulder Co Toyota Dealership Near Loveland

Used Vehicles Boulder Co Used Cars Suvs Trucks 89 In Stock

89 Used Cars In Stock Boulder Di Target City 1 Fisher Auto

New Honda For Sale In Boulder Co Fisher Honda

Boulder County Coroner Ids Longmont Driver Killed In Rollover Crash The Denver Post

89 Used Cars In Stock Boulder Di Target City 1 Fisher Auto

2022 Subaru Ascent Vs 2022 Hyundai Palisade In Boulder Co

Certified Used Toyota Cars For Sale In Boulder Toyota Colorado Springs